Life Insurance in and around Gardiner

Protection for those you care about

What are you waiting for?

Would you like to create a personalized life quote?

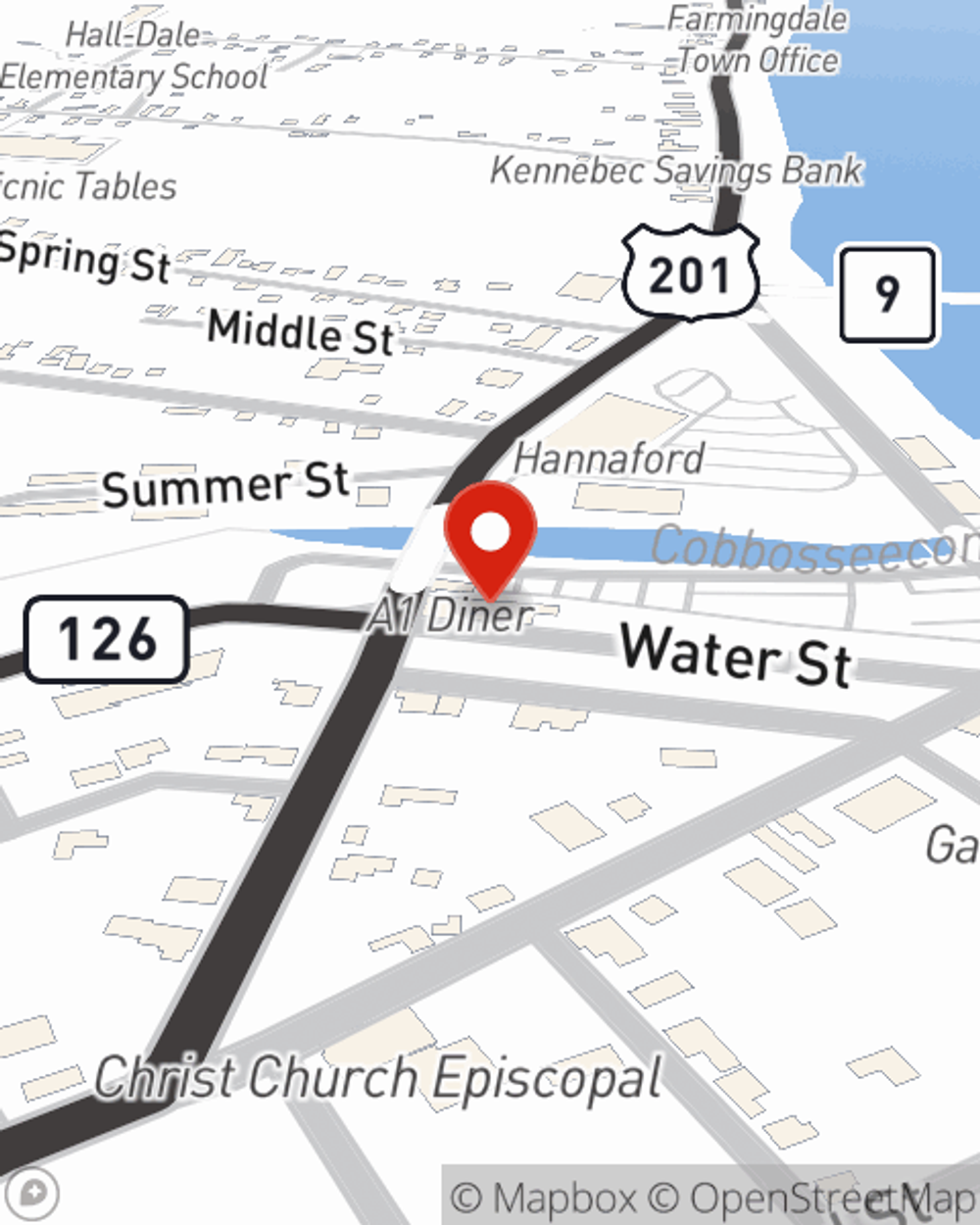

- Gardiner

- West Gardiner

- Farmingdale

- Hallowell

- Randolph

- Litchfield

- Pittston

- Boothbay Harbor

- Richmond

Check Out Life Insurance Options With State Farm

No one likes to entertain ideas about death. But taking the time now to secure a life insurance policy with State Farm is a way to show care to your loved ones if the worst happens.

Protection for those you care about

What are you waiting for?

Life Insurance You Can Trust

The beneficiary designated in your Life insurance policy can help cover certain expenses for your loved ones when you pass. The death benefit can help with things such as retirement contributions, college tuition or phone bills. With State Farm, you can rely on us to be there when it's needed most, while also providing compassionate, reliable service.

With responsible, considerate service, State Farm agent Janet Slade can help you make sure you and your loved ones have coverage if the worst comes to pass. Call or email Janet Slade's office today to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Janet at (207) 582-7100 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Janet Slade

State Farm® Insurance AgentSimple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.